Omanyano ovanhu koikundaneki yomalungula kashili paveta, Commisiner Sakaria takunghilile

Veronika Haulenga

Omanyano ovanhu koikundaneki yomalungula kashili paveta, Commisiner Sakaria takunghilile

Veronika Haulenga

Listeners:

Top listeners:

-

play_arrow

Omanyano ovanhu koikundaneki yomalungula kashili paveta, Commisiner Sakaria takunghilile Veronika Haulenga

22 October 2024 Morning Biz News: Economic Developments and Financial Indicators

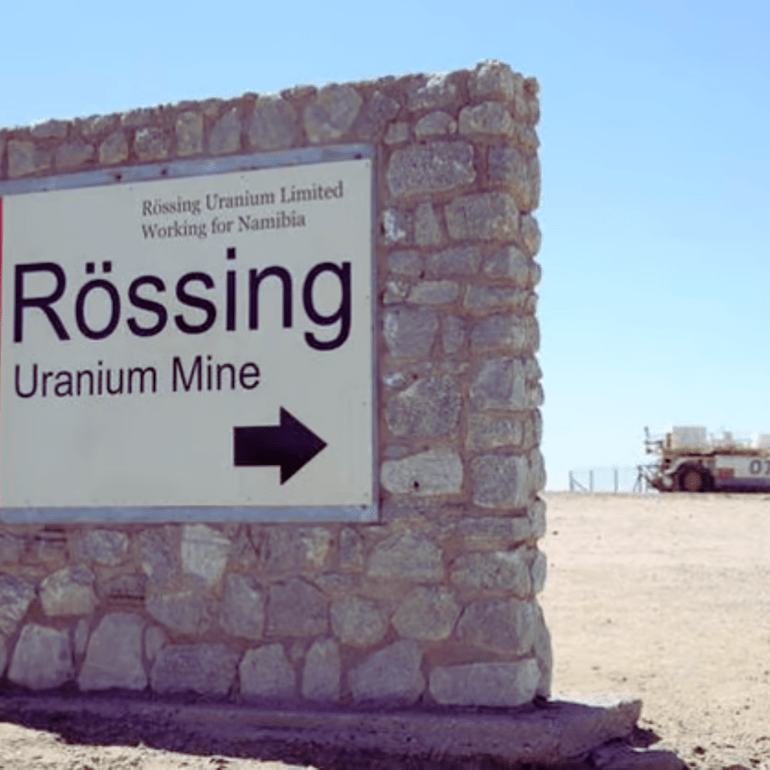

1. Rössing Uranium’s Investment Boosts Local Employment in Swakopmund

Rössing Uranium has made a significant investment of N$20 million in the construction of a new police station in Swakopmund, generating over 100 jobs for local residents since the project began in July. According to The Brief, the development is currently 46% complete and is expected to be finalized by January 2025. This initiative not only aims to enhance community safety but also provides substantial employment opportunities in the burgeoning DRC area.

2. South Africa’s Mid-Term Budget Review: Cautious Optimism Ahead

As South Africa prepares for its mid-term budget review, there are expectations of improved public finances. However, economists caution that it may be premature for the government to ease fiscal discipline. Finance Minister Enoch Godongwana is scheduled to present his first medium-term budget policy statement on October 30, detailing spending plans for the next three years under the newly formed unity government, as reported by CNBCAfrica.

3. Nigeria Blocks Shell’s Sale While Approving Exxon Mobil’s Deal

In a significant move, Nigeria has blocked Shell’s proposed sale of its entire onshore and shallow-water oil operations, which was valued at up to $2.4 billion and intended for the Renaissance consortium. In contrast, the Nigerian government has approved Exxon Mobil’s long-awaited deal with Seplat Energy, which has been pending regulatory approval for over two years since its announcement in February 2022, valued at $1.28 billion, according to Reuters.

4. Australia’s Institutional Investors Turn to Private Debt Market

As high interest rates persist and banks become increasingly cautious about lending to riskier borrowers, Australia’s large institutional investors are seeking growth in the local private debt market. IFM Investors Pty. has reported that its A$12 billion debt portfolio, which includes private credit, has grown by 20% annually over the last two years, according to Yahoo Finance.

Latest Financial Indicators

- Namibian Dollar (NAD):

- 17.61 to the US Dollar (USD)

- 19.05 to the Euro (EUR)

- 22.86 to the British Pound (GBP)

- Commodity Prices:

- Gold: $2,719.47 per fine ounce

- Brent Crude Oil: $73.06 per barrel

- Bitcoin: $1,191,129.26

These updates provide insight into the current economic landscape, highlighting significant investments and strategic decisions affecting various sectors across Africa and beyond.

Written by: Leonard Witbeen

Biz News economic developments financial updates FUTURE MEDIA NAMIBIA FUTURE MEDIA NEWS futuremedia investment news Namibia Economy

Similar posts

Mbumba signs off new benefits for retired political office bearers

todayMarch 18, 2025 5122 3

Windhoek Weather

Most popular

Mbumba signs off new benefits for retired political office bearers

Namdia Heist: More questions, lots of confusion

Omuhwahwameki Michael okuunganeka oshikonga shoku patitha oostola dho Rani moshilongo ashihe.

Walvis Bay woman loses over N$777.000 to a fraudster

Don’t let Pohamba’s tears over Nujoma’s death go to waste

Copyright 2025 Future Media (Pty) Ltd | Website by Digital Platforms

Tel: +264 83 000 1000 | Email: news@futuremedia.com.na